A Decade of Empowering Entrepreneurs

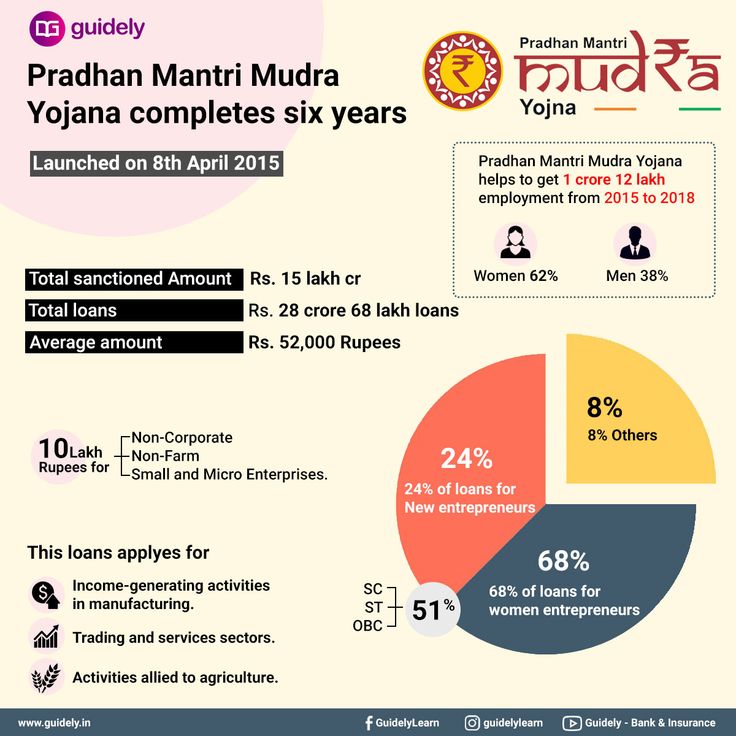

Launched in 2015, the Pradhan Mantri MUDRA Yojana (PMMY) completes 10 impactful years in 2025. This flagship initiative has offered financial access to micro and small enterprises, enabling job creation, income growth, and women-led business development.

Three-Tier Loan Structure

MUDRA Yojana categorizes loans to support different business stages:

- Shishu: Up to ₹50,000 for startups

- Kishor: ₹50,001–₹5 lakh for growing businesses

- Tarun: ₹5 lakh–₹10 lakh for established ventures

10 Years, Massive Impact

- ₹15 Lakh Crore+ Disbursed: To over 30 crore beneficiaries

- Women-led Growth: 70% of loans to women entrepreneurs

- Employment: Approx. 5 crore jobs generated

- Inclusivity: Support for SC/ST/OBC borrowers

Real-Life Success

Entrepreneurs across India have transformed lives using MUDRA support. Asha, a tailor from Bihar, expanded her small shop using a Kishor loan. Today, she employs three locals and supplies uniforms to schools in her district.

“With MUDRA’s help, I gained independence and confidence,” says Asha.

Challenges Remain

- Ensuring repayment discipline

- Enhancing financial literacy

- Improving digital loan processing

The path ahead includes more training, robust monitoring, and deeper digital integration to sustain long-term impact.

Conclusion

The MUDRA Yojana has been a catalyst for small business empowerment. As it completes a decade, its success reflects India’s commitment to grassroots entrepreneurship, financial inclusion, and a self-reliant economy.