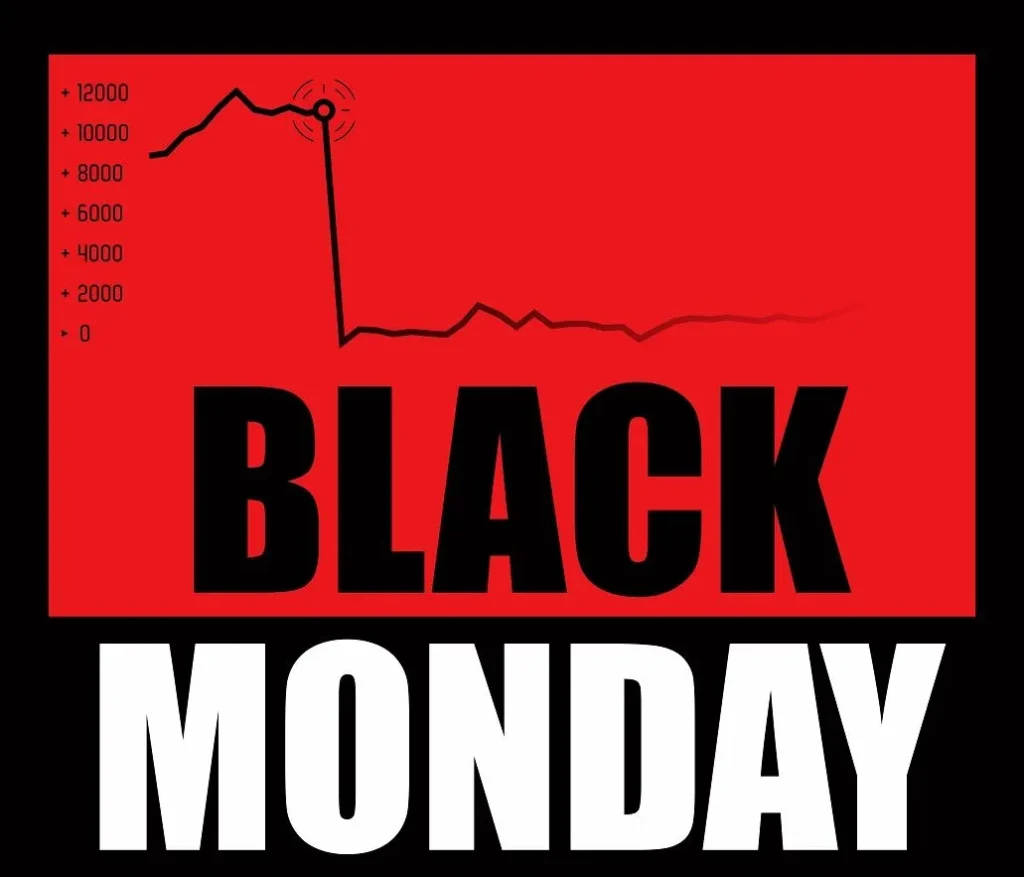

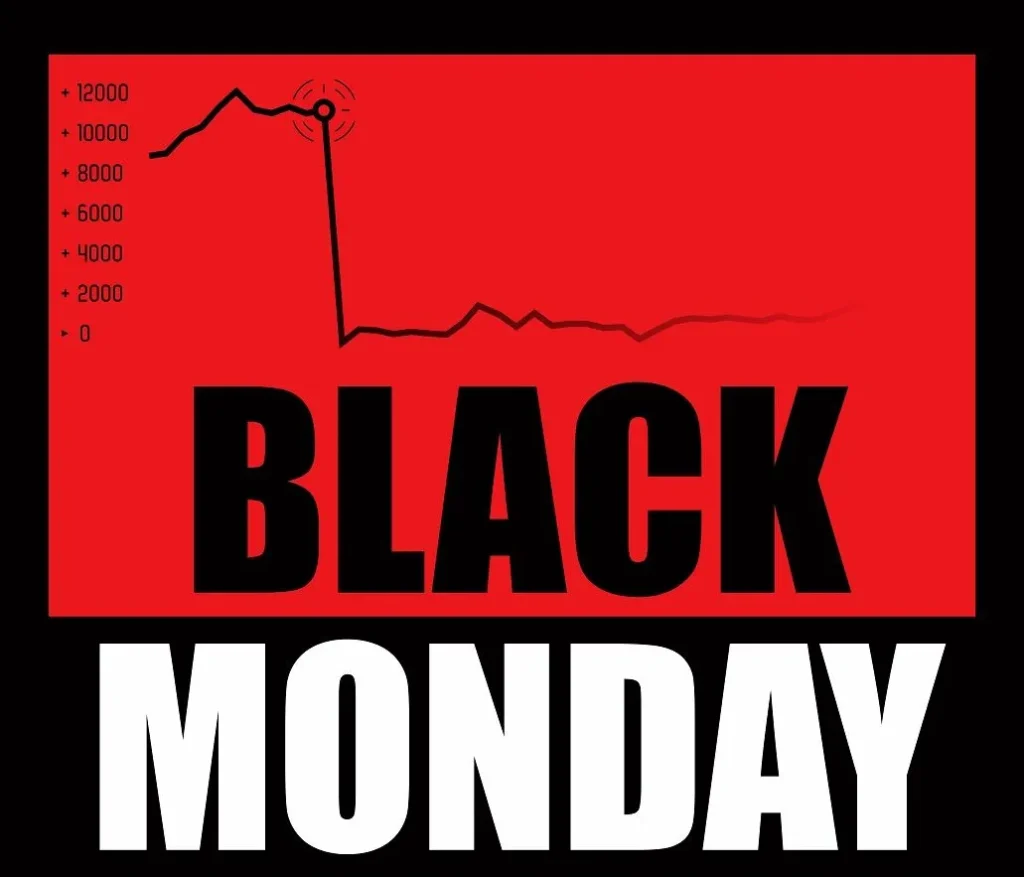

Introduction: Black Monday

In a climate fraught with economic tension, the term “Black Monday” has resurfaced, evoking fears reminiscent of the 1987 market crash. Financial analyst Jim Cramer’s recent comments on CNBC have catalyzed discussions around the potential impact of Trump tariffs, predicting a possible global market upheaval akin to that catastrophic Monday.

What Happened

On April 2, during his show “Mad Money,” Jim Cramer issued a stark warning about the current trajectory of international markets. Cramer compared the potential fallout from Trump-imposed tariffs to the infamous “Black Monday” of 1987. This historical event saw the Dow Jones Industrial Average plummet by 22.6% in a single day—a record that remains unchallenged. Cramer highlighted that similar protectionist measures and geopolitical tensions could precipitate another market disaster, affecting economies worldwide.

Social Media Buzz

The prospect of another “Black Monday” has stirred significant activity on social media platforms, particularly on X (formerly Twitter). Users are sharing graphs, historical data, and opinions on how Trump tariffs might replicate past market failures. The hashtags #BlackMonday and #TrumpTariffs are trending, with many expressing concern over potential economic repercussions. Financial experts and market enthusiasts alike are debating the plausibility of a repeat scenario, making it a hot topic in online discussions.

Impact & Insights

The warnings about a possible “Black Monday” scenario due to Trump tariffs cast a shadow over global economic stability. Economists fear that these tariffs could disrupt international trade, leading to increased costs and reduced consumer spending. Such a downturn would not only impact the stock market but could also trigger a domino effect, unsettling economies that are already struggling to recover from the COVID-19 pandemic. With the Dow Jones being a critical indicator, any significant movement could influence investor confidence and economic policies worldwide.

Looking Ahead

As we brace for potential market volatility, the focus turns to how governments and financial institutions might mitigate the risks of another “Black Monday.” Analysts suggest that diplomatic negotiations and strategic economic policies could alleviate some of the pressures caused by Trump tariffs. However, the uncertainty remains, and the financial world watches closely, hoping to avoid a repeat of the 1987 crisis.

The specter of “Black Monday” is not new; markets have periodically faced similar threats, such as the 2008 financial crisis. Understanding these past events provides valuable lessons for navigating current challenges. For further context, one might explore how previous tariff implementations have influenced global markets and learn from the strategies that successfully averted economic disasters.