India Confronts Economic Headwinds: US Tariffs and RBI’s Response

India’s economic landscape is undergoing significant shifts as the nation grapples with newly imposed US tariffs and proactive measures from the Reserve Bank of India (RBI). These developments are poised to influence the country’s growth trajectory and trade dynamics substantially.

US Tariffs: A New Challenge for Indian Exports

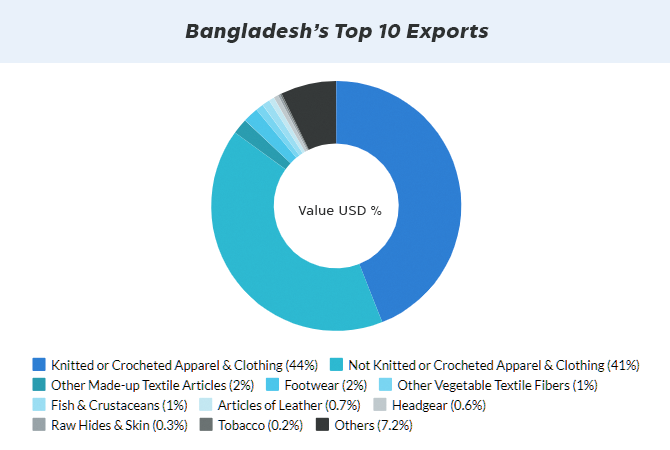

In a move that has sent ripples through global markets, the United States has levied a 26% tariff on a range of Indian imports. This decision directly impacts key sectors, including gems, chemicals, pharmaceuticals, and engineering goods. The heightened tariffs threaten to erode the competitiveness of Indian products in the US market, potentially leading to a decline in export volumes and revenue.

Finance Minister Nirmala Sitharaman addressed these concerns during the UK-India economic and financial dialogue in London. She emphasized the necessity for collaborative efforts between the RBI and the government to mitigate the adverse effects of these tariffs on the economy. Measures under consideration include extending interest subsidies and offering export incentives to support the affected sectors.

RBI’s Proactive Measures: Rate Cuts and Policy Shifts

In response to escalating growth concerns, the RBI has implemented a second consecutive cut to its key repo rate, reducing it by 25 basis points to 6.00%. This decision reflects the central bank’s commitment to stimulating economic activity amid external pressures. Additionally, the RBI has shifted its monetary policy stance from “neutral” to “accommodative,” signaling openness to further rate adjustments if necessary.

Governor Sanjay Malhotra acknowledged the challenges posed by the US tariffs, noting their potential to dampen economic growth. The RBI has accordingly revised its GDP growth forecast for 2024-25 downward to 6.5% from the previous 6.7%. Inflation projections have also been adjusted to 4% from 4.2%, indicating a cautious approach to balancing growth and price stability.

Market Reactions and Future Outlook

The financial markets have responded to these developments with heightened volatility. The Indian rupee has depreciated by 1.2% since the announcement of the US tariffs, reflecting investor apprehension. While a weaker rupee could provide a marginal boost to exports by making Indian goods cheaper internationally, it also raises concerns about imported inflation and the overall economic balance.

Economists anticipate that the RBI may implement additional rate cuts, potentially bringing the repo rate down to 5.50% by the end of the year. Such measures aim to bolster domestic demand and offset external shocks.

However, the effectiveness of these policies will depend on various factors, including global economic conditions and the trajectory of trade relations with the US.

Government Initiatives and Strategic Partnerships

Beyond monetary policy adjustments, the Indian government is actively exploring avenues to strengthen economic resilience. Efforts to finalize a free trade agreement with the United Kingdom are underway, with Finance Minister Sitharaman expressing optimism about the progress of bilateral discussions. Such agreements could open new markets for Indian exporters and reduce dependency on any single trade partner.

Additionally, the government is considering extending interest subsidies and providing targeted export incentives to sectors most affected by the US tariffs. These initiatives aim to enhance the competitiveness of Indian products and support industries in navigating the challenging international trade environment.

Conclusion

India stands at a critical juncture, facing external challenges that test the resilience of its economy. The combined impact of US tariffs and domestic policy responses will shape the nation’s economic trajectory in the coming months. Through a blend of strategic policy measures, international collaborations, and support for key industries, India aims to navigate these turbulent times and sustain its growth momentum.

Stakeholders across sectors will need to remain vigilant and adaptive, leveraging opportunities that arise and mitigating risks associated with the evolving global economic landscape.